Economy

Court to Decide Money Laundering Case Against Binance Next Week

By Adedapo Adesanya

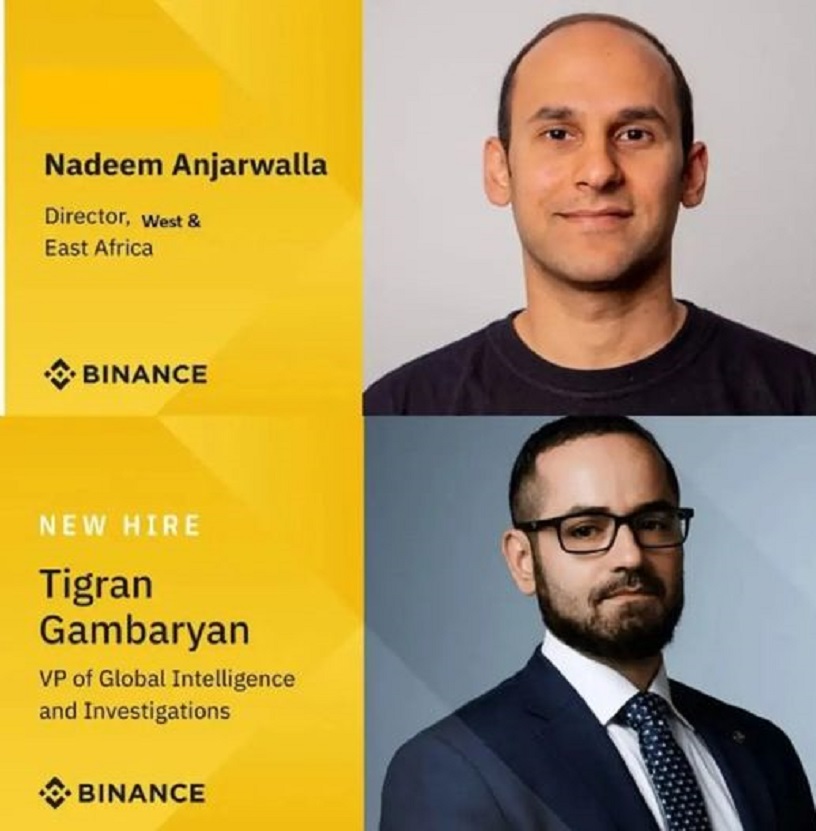

A Federal High Court will hear the money laundering case against crypto exchange, Binance, and two of its executives, Mr Tigran Gambaryan, and the fugitive British-Kenyan regional manager for Africa, Mr Nadeem Anjarwalla, next week, a month earlier than planned.

The next court hearing, originally scheduled for October 11, has now been fixed for September 2.

According to a report by Reuters, defence lawyers asked for the date change and it was granted, the prosecutor said on Monday.

Binance and the executives have been charged by the Nigerian government with laundering over $35 million. The world’s largest cryptocurrency exchange is also facing accusations of tax evasion.

Nigeria also blamed Binance for its currency weakness after cryptocurrency websites became the platforms of choice for trading the Nigerian Naira as the country grappled with chronic dollar shortages and its currency fell to a record low.

In March, Binance stopped all transactions and trading in Naira after a country-wide crackdown on crypto exchanges that have been blamed by authorities for feeding a black market for foreign exchange.

Mr Anjarwalla escaped from detention and left Nigeria before the trial started after he and Mr Gambaryan were detained in Nigeria since February.

According to his wife, Yuki Gambaryan, his health has deteriorated in prison, appealing to the Nigerian government to drop the charges against her husband and release him on health grounds. She has also asked the US government to help secure his release.

In July, Mr Gambaryan was brought to the courtroom in a wheelchair dressed in a black T-shirt with blue jeans trousers but stood up from the wheelchair and walked slowly into the dock.

The EFCC lawyer, Mrs Ogechi Ujam, told the court that though the matter was scheduled for the continuation of trial, the commission’s lead counsel, Ekele Iheanacho, was not in court.

Mrs Ujam had prayed the court to stand down the matter to enable Iheanacho to conduct the trial.

Lawyer to Binance, Mr Babatunde Fagbohunlu (SAN), and Mr Mark Mordi, who represented Mr Gambaryan, did not oppose the application.

Justice Emeka Nwite stepped down on the matter.

Justice Emeka Nwite had, on July 5, ordered the management of the Nigerian Correctional Service (NCoS) to release the medical certificate of the accused on or before July 16.

The judge gave the order following an application by Mr Gambaryan’s lawyer.

Mr Mordi had prayed the court to summon the medical doctor at the health facility of Kuje Correctional Centre, to explain why he had allegedly refused to make available his client’s medical report despite an earlier court order.

Economy

Bears Recapture Local Bourse, Inflict N77bn Loss on Investors

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited suffered a 0.11 per cent loss on Thursday after the bears made a comeback after being chased away by the bulls a day earlier.

The local bourse was under attack despite a positive market breadth index and strong investor sentiment after it ended with 29 appreciating stocks and 23 depreciating stocks.

Business Post observed that profit-taking in some mid-equities plunged Customs Street during the trading session, with Fidson shedding 9.60 per cent to trade at N17.90.

Ecobank Nigeria depreciated by 9.51 per cent to sell for N31.40, Guinea Insurance lost 8.33 per cent to quote at 66 Kobo, Prestige Assurance slipped by 7.50 per cent to N1.11, and Sunu Assurances crashed by 6.44 per cent to N5.52.

On the flip side, PZ Cussons gained 10.00 per cent to settle at N32.45, Oando improved by 10.00 per cent to N52.80, Honeywell Flour appreciated by 9.96 per cent to N13.03, Caverton jumped by 9.80 per cent to N2.69, and Livestock Feeds rose by 9.35 per cent to N6.90.

Yesterday, the energy counter appreciated by 0.88 per cent and was the only gainer among the key sectors of the market.

The insurance sector went down by 0.92 per cent, the banking index depreciated by 0.75 per cent, the industrial goods space crumbled by 0.43 per cent, and the consumer goods sector lost 0.17 per cent, while the commodity counter closed flat.

Consequently, the All-Share Index (ASI) decreased by 123.53 points to 107,675.46 points from 107,798.99 points and the market capitalisation retreated by N77 billion to N67.102 trillion from N67.179 trillion.

A total of 423.4 million equities worth N9.6 billion were traded in 11,112 deals on Thursday compared with the 245.5 million equities valued at N8.4 billion transacted in 10,098 deals on Wednesday, representing a rise in the trading volume, value, and number of deals by 72.46 per cent, 14.29 per cent and 10.04 per cent, apiece.

The activity chart was topped by FCMB with 102.3 million stocks valued at N1.1 billion, Zenith Bank transacted 33.3 million equities worth N1.6 billion, Access Holdings exchanged 31.2 million shares for N801.9 million, Jaiz Bank traded 24.4 million equities worth N82.0 million, and Caverton sold 20.9 million stocks valued at N54.6 million.

Economy

FG, States, LGAs Share N1.703trn as January 2025 Revenue Rises 19%

By Adedapo Adesanya

The federal government, the 36 states, and the 774 local government areas of the federation have shared a total of N1.703 trillion in revenue generated in January 2025.

This amount represents an increase of 19.6 per cent or N279 billion from the N1.424 trillion generated in December 2024.

This is according to a press release by the Director (Press and Public Relations) at the Office of the Accountant General of the Federation, Mr Bawa Mokwa, on Thursday,

The N1.703 trillion total distributable revenue comprises N749.727 billion in statutory revenue, N718.781 billion in Value Added Tax revenue, N20.548 billion from the Electronic Money Transfer Levy, and N214 billion in augmentation.

The statement was based on a communique issued by the Federation Account Allocation Committee (FAAC) after its monthly meeting for February 2025.

It noted that the total gross revenue amounted to N2.641 trillion, which was slightly higher than the N2.310 trillion recorded in the previous month.

The total deduction for cost of collection was N107.786 billion while total transfers, interventions, refunds and savings was N830.663 billion.

It was disclosed that the federal government received N552.591 billion, state governments were allocated N590.614 billion, and the Local Government Councils received N434.567 billion, while an additional N125.284 billion was shared with benefiting states as derivation revenue as 13 per cent of mineral revenue.

The statement further noted that the gross statutory revenue for the month under review stood at N1.848 trillion, an increase of N622.125 billion from the N1.226 trillion recorded a month earlier.

Gross VAT revenue for the month was N771.886 billion, rising by N122.325 billion from N649.561 billion in December.

From the N749.727 billion statutory revenue, the federal government got N343.612bn, the state governments were given N174.285 billion, and the councils received N134.366 billion, while N97.464 billion was also allocated to states benefiting from derivation revenue.

Further, from the N718.781 billion VAT revenue, the federal government received N107.817 billion, state governments were got N359.391 billion, and Local Government Councils shared N251.573 billion.

For the N20.548 billion Electronic Money Transfer Levy (EMTL), the federal government received N3.082 billion, state governments received N7.192 billion, and Local Government Councils received N10.274 billion.

The N214 billion augmentation was shared with the federal government receiving N98.080 billion, state governments receiving N49.747 billion, and Local Government Councils receiving N38.353 billion, while N27.820 billion was shared among the benefiting states as derivation revenue.

The communique also highlighted increases in collections from VAT, Petroleum Profit Tax, Companies Income Tax, Excise Duty, Import Duty, and CET Levies, while there was a significant decrease in EMTL and Oil and Gas Royalty receipts.

Economy

Oil Prices Jump as Trump Revokes Chevron’s Venezuela Licence

By Adedapo Adesanya

Oil prices rose more than 2 per cent on Thursday amid supply concerns after the US President, Mr Donald Trump, revoked a licence granted to US oil major, Chevron, to operate in Venezuela.

The news led Brent crude oil futures to spike by $1.53 or 2.1 per cent to $74.06 a barrel while the US West Texas Intermediate (WTI) crude oil futures increased by $1.64 or 2.4 per cent to $70.26.

The Chevron licence revocation means the company will no longer be able to export Venezuelan crude.

However, if Venezuelan state oil company, PDVSA, exports oil previously exported by Chevron, US refineries will be unable to buy it because of U.S. sanctions.

President Trump said this was due to the lack of electoral reform in the South American country alongside with insufficient action on migration.

Chevron has been exporting around 240,000 barrels of Venezuelan crude to the US daily after former US President Joe Biden granted them a waiver.

The amount constitutes around 25 per cent of the country’s total oil production and generates substantial revenues that stay in the Venezuelan economy.

Meanwhile, market analysts noted that the move could also lead to the negotiation of a fresh agreement between the Chevron and PDVSA to export crude to destinations other than the US.

This development could also impact the Organisation of the Petroleum Exporting Countries and its allies, OPEC+, to which Venezuela is a member.

Chevron’s exit could reduce Venezuela oil’s production, giving OPEC+ capacity to increase output.

However, investors were still keeping an eye on signs of a potential peace deal in Ukraine, which could result in higher Russian oil flows.

President Trump said Ukrainian President Volodymyr Zelenskiy will visit the US on Friday to sign an agreement on rare earth minerals.

However, the Ukrainian leader said the success of talks would hinge on continued US aid.

The market was pressured by news that US economic growth slowed in the fourth quarter amid cold weather and concerns that tariffs will hurt spending through higher prices.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN